Case Study

Credit Union of Georgia

How a long-term relationship brought big value to a small marketing team.

Client Stats

Asset Size: $465mil (as of 4Q20)

HQ: Woodstock, Georgia

Branches: 8

Target Audience

- Residents of several north Atlanta counties

- Education-oriented (credit union was founded as a teacher’s credit union)

Big Challenge

The VP of Marketing also oversees business development and compliance, while helping with HR and training. There is only one staffer dedicated to marketing.

THe power of connecting

A long-term relationship reduces stress, builds trust, and sets the client up for success.

Amanda, the VP of Marketing at Credit Union of Georgia, stopped by a sponsor table I had some five years ago at a regional CU league event. We’ve been working together since that fateful meetup – creating annual reports, advertising campaigns, and other marketing materials over the years. But more importantly, we’ve created a relationship which supports as she grows her position and her credit union.

Lowering Stress

This benefit started pretty early in our working relationship. The projects Amanda sends me take a lot off her plate. She doesn’t need to worry about generating ideas, headlines, copy or design. She also doesn’t have to spend any time explaining disclosures or other industry-specific concerns. And as I’ve studied their mode of operating, their brand, market & membership, Amanda is now able to just give me the high points of a project – saving her time and stress of writing up emails or time on the phone.

Building Trust

Reducing stress and building trust are key components of a valued vendor relationship. Amanda can focus on other aspects of her job instead of having to ‘babysit’ me and our projects. She knows I’ll deliver effective designs and copy well within the deadlines. She also trusts me with details such as providing files which meet production standards and are free of typos.

Client Success

The Credit Union of Georgia has grown faster than other credit unions in their market, adding three new locations in just the past few years. And they are doing so in a very competitive market! Amanda has also successfully navigated transitions to a new CEO twice – and a rebrand while we’ve been working together. It’s a privilege to be a part of her team as she builds success for herself, and her credit union.

Creative Direction

Over the years of working with the Credit Union of Georgia, the styles and methods have changed to reflect current trends and branding efforts. One of the core threads has been to create designs which appeal to their core target audience: suburban Atlanta females in their 30s & 40s.

For several years, we created designs without people in order to help their promotional materials stand out from other banks in the area.

Then as a new CEO came on board, people-centered designs become the desired outcome.

Most of these designs were used on their own internal channels: in-branch video boards, estatements, online banking, etc., so we could focus on the product itself. There was no need to use logos, or promote membership benefits. These ads were pure product.

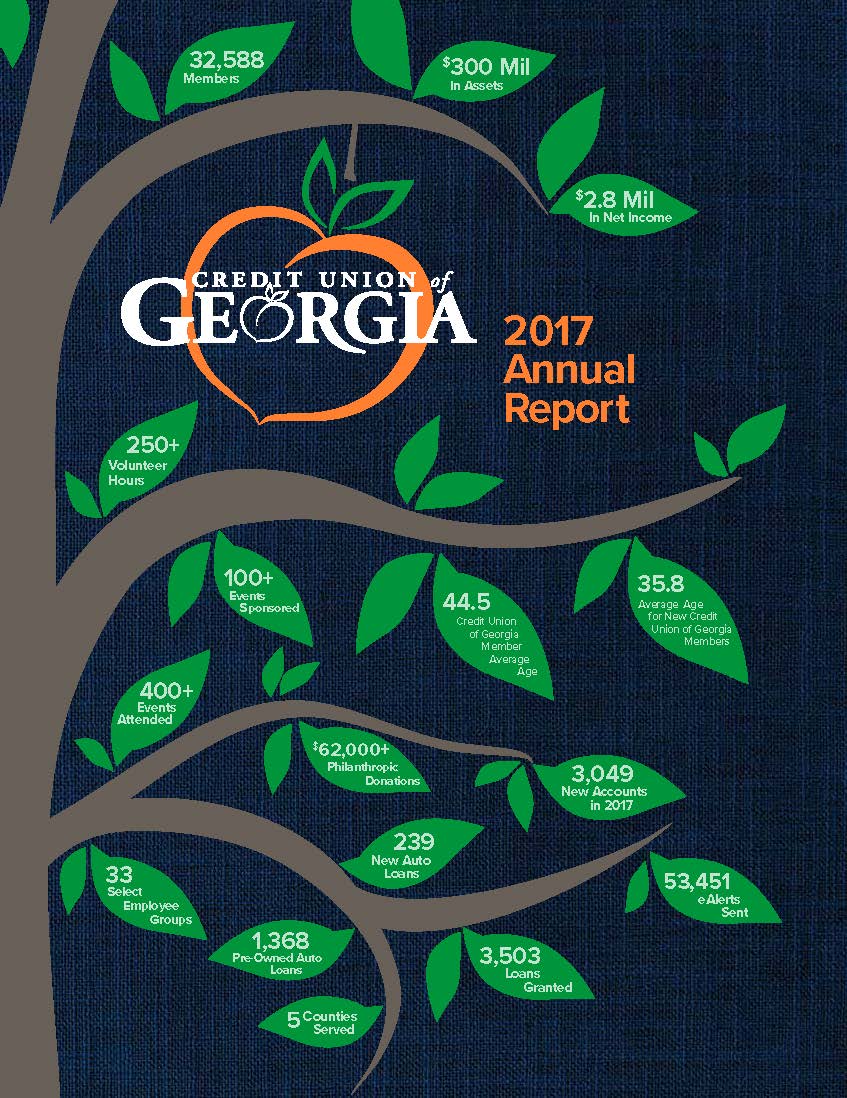

Annual REports

Ah, the Annual Report. A yearly quest to create interesting ways of presenting data and leadership messaging.

For some annual reports, Amanda sent along the leadership letters already written and for others, she provided the highlights they wanted to cover then I wrote the letters. We also switch up the printing oversight depending on what she’s needing each year. Sometimes she’ll get them printed and oversee the production, other times I’ve used one of my trusted printers.

The Credit Union of Georgia uses these annual reports just at the annual meetings. They are short-lived documents, yet very critical for meeting regulations, reflecting the Board’s culture and leadership, and certainly to report on the finances.

Lean On Me

When you’re ready to have a creative cohort, get in touch! From coaching your in-house staff through writer’s or designer’s block, to creating the designs for you, lean on me to help you get work done.